Loan Options for Clients

Every client is different. So we have more than 400 loan options to help.

No need to refinance your existing mortgage

Loan amounts of $100,000 - $3,000,000

Rate

Term

Borrowing power

Disbursement

Fixed

15-30 years

Up to 90%

loan-to-value

Full loan amount at closing

Fixed Rate

Peace of mind of a fixed rate, often at a lower rate than a HELOC. Typically for faster projects

No need to refinance your existing mortgage

Loan amounts of $100,000 - $750,000

Rate

Term

Borrowing power

Disbursement

Variable or Fixed

15-30 years

Up to 90%

loan-to-value

Line of credit with checkbook to spend funds

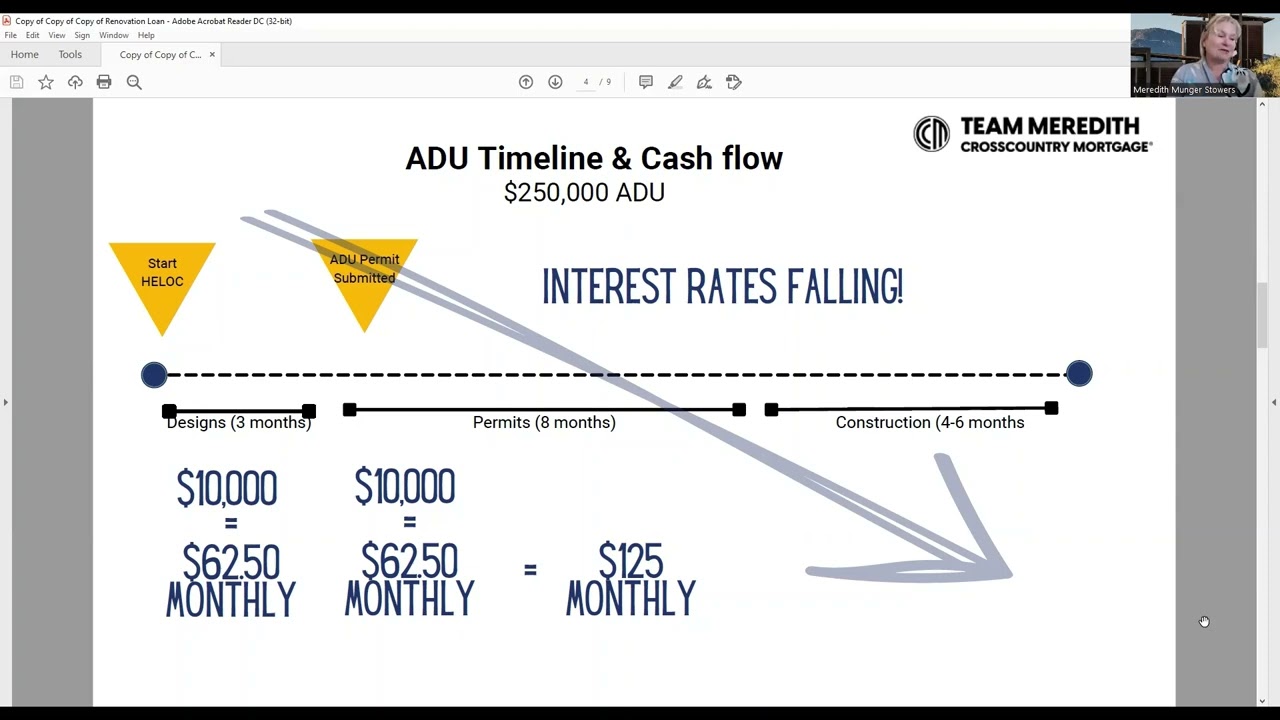

HELOC

Flexibility of drawing what you need, when you need it, and only paying on what you use.

Loan amounts of $100,000 - $3,000,000

Rate

Term

Borrowing power

Disbursement

Fixed or Variable

15-30 years

Up to 110%

of future loan-to-value

Draws provided as needed during construction

Renovation Loan

Whether purchasing a property or refinancing, you can add the construction budget to your mortgage.

Loan amounts of $100,000 - $3,000,000

Rate

Term

Borrowing power

Disbursement

Fixed or Variable

15-30 years

Up to 110%

of future loan-to-value

Draws provided as needed during construction

Construction Loan

Peace of mind of a fixed rate, often at a lower rate than a HELOC. Typically for faster projects